Home » Geologic Hazards » Homeowners Insurance

Homeowners Insurance Does Not Cover Many Types of Damage

Flood, earthquake, expansive soil, hurricane, landslide and subsidence damage is often not covered!

Article by: Hobart M. King, PhD

Flooded community: Flooding is one of the most common disasters that is not covered by the typical homeowners insurance policy. However, flood insurance can often be purchased at a reasonable price. Photo of a flooded residential area in Greenville, North Carolina by Jerry Ryan, United States Geological Survey.

"All Perils" Means: Learn About the Geology

Every year in every state, many property owners discover that their homeowners insurance policy will not pay when their homes are damaged by common geological processes such as earthquakes, expansive soils, floods, hurricanes, landslides and subsidence. These homeowners probably had the impression that their "all perils" insurance policy would pay for almost any type of damage that their home would experience.

I felt the same way when I purchased my first homeowners insurance policy. I distinctly remember sitting in the agent's office and listening to him tell me that I was buying an "all perils" policy. I felt good about that because I was covered for "all perils." I didn't read the policy word-by-word to see what it really covered - who reads 50-page insurance policies issued by leading companies in the insurance industry? Everyone assumes that they cover everything. It's an "all perils" policy, right?

A few years later, my work as a geologist brought me in contact with lots of homeowners who were unable to collect when their homes were damaged by floods, landslides, subsidence and other problems. I was surprised at how many people received this rude insurance awakening. At first I blamed it on "cheap insurance." Then I began to realize that the people I met under these circumstances were not going to have their losses covered by their insurance company - not even by the companies that I always thought were the leaders of the insurance industry.

Homeowners insurance exclusions: A portion of the author's homeowners insurance policy that excludes the most common geologic hazards (underlined in red). Check your homeowners policy to determine if it covers hazards that are likely to occur in your area. Your insurance agent might be able to help you obtain additional coverage for hazards of concern in your area.

An Idea for Insurance Companies:Perhaps insurance companies could generate an enormous boost in revenues by offering their current policies as "fire, wind and limited liability coverage" (or another appropriate title). They could then offer a real "all perils" policy for a higher price. Don't you think a lot of people would appreciate this clarity and security -- and opt for the upgrade? |

"Exclusions: What We Do Not Cover"

One day I received an updated policy from my insurance company in the mail and I decided to spend a little time reading. I wanted to find out if my policy would cover the same disasters that I saw other people suffering. Sure enough, the policy had an exclusions statement that listed a large number of geologic hazards. The list of exclusions was almost identical to the table of contents of an environmental geology textbook. There was no coverage for landslides, floods, mine subsidence, mud slides, mud flows, volcanic eruptions, surface water, sewage and a long list of other problems.

I have since looked at the exclusions statements of many homeowners insurance policies, and my personal opinion is that the typical homeowners insurance policy is often just a fire and limited liability policy - and maybe some coverage for damage done by falling objects and wind.

Your homeowners insurance probably does not cover half of the things that you assumed it would.

In my opinion, the "all perils" name is misleading because the coverage excludes so many different types of losses that commonly occur. Many homeowners never learn about these exclusions until after they have paid premiums for many years and then suffer an uncovered loss.

The lesson to be taken away from this is: "Learn about the geology before you buy the house." If the home has some geological risk you should not buy it. Or, you should know exactly what your risks are and either find specific insurance to cover them or live in the house informed of your exposure.

Below I have done my best to summarize what many homeowners policies do not cover and provide links to more detailed information. More detailed learning for these topics can be obtained by reading an environmental geology book or taking an environmental geology course at a university. For site-specific information you can contact a consulting geologist or the geological survey that serves the area where the house is located.

| Expansive Soils Map |

| Over 50 percent of these areas are underlain by soils with abundant clays of high swelling potential. | |

| Less than 50 percent of these areas are underlain by soils with clays of high swelling potential. | |

| Over 50 percent of these areas are underlain by soils with abundant clays of slight to moderate swelling potential. | |

| Less than 50 percent of these areas are underlain by soils with abundant clays of slight to moderate swelling potential. | |

| These areas are underlain by soils with little to no clays with swelling potential. | |

| Data insufficient to indicate the clay content or the swelling potential of soils. |

Expansive soils map: The map above is based upon "Swelling Clays Map of the Conterminous United States" by W. Olive, A. Chleborad, C. Frahme, J. Shlocker, R. Schneider and R. Schuster. It was published in 1989 as Map I-1940 in the USGS Miscellaneous Investigations Series. This map was generalized for display on the web by Bradley Cole of Geology.com. More information is included in a Geology.com article on expansive soils. Click to view a larger map.

Expansive Soils and Homeowners Insurance

In a typical year in the United States, expansive soils cause damage to more homes than earthquakes, floods, hurricanes, and tornadoes combined. Most homeowners insurance policies do not cover damage from expansive soils.

Expansive soils contain a significant amount of clay which can expand when wet and shrink when dry. These volume changes can generate enormous forces which can damage foundations, underground utilities, sidewalks, driveways and other parts of a home. The United States Department of Agriculture estimates that one half of the homes in the United States are built on expansive soils, and one half of these will have some damage.

There are certain areas of the United States where expansive soils are beneath much of the land. A general guide to where they are is shown in the map and references on this page. In those areas where expansive soils are a known problem, professional inspection for the presence of expansive soils or expansive soil damage should be done before purchasing an existing home or construction lot. Small areas of expansive soils occur almost anywhere so inspection is never a bad idea.

Many state geological surveys have detailed information about local expansive soil problems. The United States Department of Agriculture has a publication titled "Understanding Soil Risks and Hazards" that explains some of the problems with expansive soils.

| Earthquake Hazard Map |

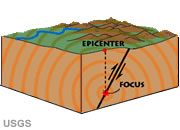

Earthquake Hazard Map: Probabilistic seismic hazard maps have been prepared for the United States by the United States Geological Survey. They show areas of elevated earthquake hazard and are used to develop building codes, insurance rate structures, risk assessments, and other public policies.

Earthquake Insurance

The typical homeowners insurance policy does not cover damage from earthquakes. A homeowner who desires this coverage normally needs to purchase a "named perils" policy - an earthquake insurance policy.

One way to do this is to ask your homeowners insurance agent if your policy provides earthquake coverage. If the policy does not cover earthquake damage, then ask where you can purchase the coverage. Some insurance companies will add earthquake insurance coverage to an existing homeowners policy for an additional annual fee. In some geographic areas, earthquake insurance is available through government-sponsored programs such as the California Earthquake Authority. Many insurance agents can advise on the companies and government programs that offer earthquake coverage in your area.

Another question that many homeowners ask is: "Do I need earthquake insurance?" There are a few situations where a homeowner must have earthquake insurance to comply with mortgage requirements. However, for most people the answer depends upon where the home is located and the level of risk that the homeowner is willing to take.

The earthquake hazard map on this page shows the geographic variability of earthquake hazard in the conterminous United States. Light gray areas on this map have the lowest hazard and the pink areas have the highest. Earthquake insurance is probably a very good idea in the red, pink, and orange areas. If I lived in these areas, I would buy the insurance for my residence and for a commercial building if I owned one. It is a prudent idea in the yellow areas. Earthquake hazards are lower in the green, blue, and gray areas. If you live in one of these areas and want the peace of mind that you are financially protected in the event of damage, then the insurance is a good purchase. I live in southwestern Pennsylvania and do not have earthquake insurance - perhaps I will regret that someday.

Flood Insurance

According to the National Flood Insurance Program, floods are America's #1 natural disaster. They occur in every state and almost every community. Homeowners insurance usually does not cover flood damage so it is very important to understand the flood hazards at your location and obtain appropriate insurance coverage if needed.

The Federal Emergency Management Agency provides address-specific flood hazard information at their Flood Map Service Center. There you can type in your address and learn about the specific flood hazards at your location. They also have information for assessing flood hazards and purchasing flood insurance on the FloodSmart website.

FloodSmart recommends flood insurance even if you live in an area of low to moderate risk. This is because 25% of all flood insurance claims come from areas with minimal flood risk. Flooding occurs there during exceptionally large flood events and also as a result of local drainage problems. Purchasing insurance in these areas is often inexpensive - it starts as low as $59/year for renters (contents coverage only) or $129/year to cover a home and its contents.

Hurricane Fran: Satellite image of Hurricane Fran, a large, powerful, destructive hurricane that made landfall near Cape Fear, North Carolina on September 5, 1996. It was so destructive that the name "Fran" for a tropical storm or hurricane was retired from use. Satellite image by NASA.

Hurricane Insurance

Homeowners insurance usually does not cover "hurricanes." Instead, the coverage or exclusion is based upon which element of a hurricane (such as wind, waves or flooding) directly caused the damage.

These issues are not easily resolved and often must be settled in court. For example: a house was flooded by a storm surge, and the homeowner claims that since the surge was produced by wind that the damage should be covered. The insurance company maintains that they do not pay for flood damage. Many of these types of cases - based upon definitions and impacts - are difficult to resolve.

Persons who buy property in areas that might experience hurricanes should learn about the types of hazards that come with these storms and how they impact the specific location where they will live. History is often a very good teacher. For example, if a location was inundated by storm surge in the past, then a future inundation will probably occur.

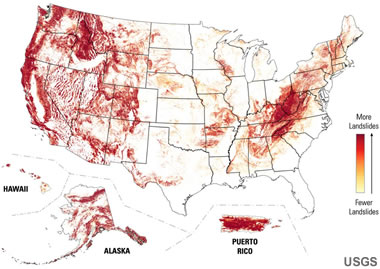

| Landslide Susceptibility Map |

Landslide Map: Map of relative landslide susceptibility across the United States. Red areas have the highest susceptibility. USGS Map. Enlarge map. More information about landslides.

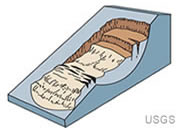

Landslide Insurance

Homeowners insurance usually does not cover landslide damage. I have been to many homes that have been damaged by landslides and know of only one situation where the homeowner's insurance company paid for the loss (after a lawsuit determined that the damage was done by a rockfall and the policy did cover damage from falling objects). Anyone who intends to buy or build a home on sloping land should be cautious about potential landslide problems. Properties above a slope or at the base of a slope can also be at risk.

Although landslide problems occur in all 50 states, some areas have a much greater incidence than others. The three factors which determine incidence are: 1) slope steepness, 2) soil strength, and 3) moisture content of the soil. The landslide map on this page shows areas with a high incidence of landslide problems in red. Persons buying or building in these areas should be especially cautious because of the special conditions which occur there.

The best way to protect yourself is to avoid buying or building in hazardous areas. If you are in doubt, have an expert inspect the site and look for building damage that indicates a building under stress. Even if no landslide problems are revealed by the inspection, be aware that excavation, grading, or fill placement can increase landslide probability. Also, landslide damage on adjacent properties is a good indicator that your home might be at risk - and will often result in difficult resale. Always be cautious on slopes and seek expert advice if you are uncertain. State geological surveys often have detailed information about local landslide hazards and problems.

| Coal Field Map |

Areas underlain by coal: Coal is present in many parts of the United States. In some of those areas it has been subject to extensive underground mining, which can result in surface subsidence and property damage. Enlarge map. See more details related to this USGS coal fields map.

Florida subsidence: Development of a new irrigation well in west-central Florida triggered hundreds of sinkholes over a 20-acre area. The sinkholes ranged in size from less than 1 foot to more than 150 feet in diameter. USGS image. See person in center for scale.

Arizona Earth fissure: A sign warning motorists of subsidence hazard was erected after an earth fissure damaged a road in Pima County, Arizona (left). Earth fissure near Picacho, Arizona (right). USGS images.

| Karst Map |

Karst Map: Map of areas underlain by water-soluble rock units such as carbonates, sulfates and halides with the potential to produce karst features. These include sinkholes, solution valleys, and solution-sculptured rock ledges that can cause problems for buildings, roads and underground utilities. A more detailed version of this Engineering Aspects of Karst Map is available on the USGS website.

Subsidence Insurance

Subsidence is usually not covered by homeowners insurance. The most common and damaging subsidence occurs in areas above underground mining. Here, voids opened during mining slowly or suddenly collapse. This can damage buildings, roads and utilities above. Your home can be damaged or ruined by this type of subsidence or it can be condemned - even if it is not damaged.

Condemnation occurs when a government inspector determines that your home is unsafe for occupancy. It can also occur if the utility and road infrastructure of a neighborhood becomes too expensive or impossible to maintain. Then local government can condemn the property and prohibit occupancy. If your home is condemned you are required to move out - even if you rent, owe $500,000 on the mortgage, or own the home free and clear.

Mine subsidence occurs where coal or another mineral resource has been removed below the surface. The coal field map on this page and link to the USGS Coal Fields website shows where this is most likely to occur. More specific information and underground mine maps can often be obtained from state geological surveys or mine regulation agencies. These agencies can often tell you about minable resources beneath your property and provide information on past or present mining activity. You don't need mine subsidence insurance if your building is in an area with no minable resources below.

Avoiding properties above mined out areas is the best way to be safe from mine subsidence. However, existing structures over mines can often be insured through government mine subsidence insurance programs or through supplemental policies from insurance companies. Your homeowners insurance agent should be able to advise you on where it can be obtained, or you might contact a government agency in your state to ask.

The area where I live is entirely underlain by the Pittsburgh Coal, which was mined out decades ago. Although the seam is a few hundred feet below the surface and there is no obvious subsidence damage in my area, I bought mine subsidence insurance from the Pennsylvania Mine Subsidence Insurance Fund. For about $170/year I have up to $250,000 in coverage. Contact your insurance agent for information.

Subsidence can also occur from natural voids below, such as underground caverns in limestone. Extensive cavern systems are beneath large areas of some states. The United States Geological Survey has information on areas where potential karst subsidence can occur.

Subsidence also occurs in some areas where large volumes of water or oil are being extracted through wells. In these areas the water aquifer or oil reservoir begins to compact, and that compaction results in subsidence or fissuring at the surface. The United States Geological Survey has information about subsidence in response to water and oil production.

| More Geologic Hazards |

|

Largest Hurricanes |

|

Gifts That Rock |

|

Storm Surge |

|

World Record Lightning |

|

Earthquakes |

|

Landslides |

|

Expansive Soil |

|

Hurricane Names |

Find Other Topics on Geology.com:

|

| ||

|

| ||

|

| ||

|

|