Home » Oil and Gas » Understanding Natural Gas Prices

Understanding Natural Gas Prices

Prices change over time and by location in response to supply, demand, and other factors.

Article by: Hobart M. King, PhD, RPG

| Average Residential Natural Gas Price By State |

Natural gas price map: The price of natural gas is not uniform across the United States. Instead, the price is determined by supply,

demand, proximity to production, regulatory environments, and the cost of natural gas that is flowing in the local distribution system.

Historically, people who live in areas where lots of natural gas is produced or areas served by major pipelines pay the lowest prices.

However, new discoveries of natural gas in shales are disrupting this pattern. Shales are now being tapped for so much gas that the supply exceeds demand or pipeline capacity in many areas. Unfortunately, local residential prices in these areas have not declined yet because distribution systems that supply residences still receive gas from far away or gas that was purchased by the utility under a long-term agreement with a fixed price.

In addition, LNG (liquefied natural gas) is now being shipped from areas where just a few years ago, natural gas was considered a "waste product" of oil production. New LNG regassification terminals will bring competition and change long-term price structures.

The geography of natural gas prices is expected to change significantly over the next decade.

Image by Geology.com using natural gas price data for calendar year 2008 from the United States Energy Information Administration.

A Time of Volatile Natural Gas Prices

During the past decade, the processes of hydraulic fracturing and horizontal drilling have liberated enormous amounts of natural gas from shale - a rock unit that rarely yielded gas to the drill in the past. Now, all of that new natural gas capacity is flowing into the market and changing the dynamics of natural gas pricing. In some areas such as the Marcellus Shale region, so much new natural gas is now available that existing pipelines are inadequate to take it away from the well sites.

All of this new natural gas capacity has produced a current price of natural gas that is much lower than levels of just a decade ago. That is great news for consumers, but for the energy companies, the lower price has damaged their anticipated profits.

How Are Natural Gas Prices Determined?

The price that a buyer pays for natural gas depends upon many factors. Three of the more important factors are: 1) the quantity of gas being purchased, 2) the amount of processing that has been done to prepare the gas for the buyer, and, 3) the amount of transportation required to deliver the gas to the buyer.

Who Pays the Lowest Price?

Lowest gas prices are paid by companies who purchase the gas as it flows from a well. This is known as the "wellhead price." These buyers receive a low price because they purchase very large amounts of gas that have not been processed or transported.

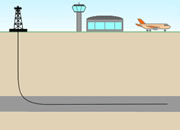

Natural Gas Price Sectors: The lowest natural gas prices are paid by companies who buy large volumes of unprocessed gas at the wellhead. Highest prices are paid by homeowners who use small volumes of gas that must be processed, transported, metered, billed, and supported with maintenance and customer service staffs. Wellhead image by OSHA.gov. Suburban street image copyright iStockphoto / Nicholas Monu.

Who Pays the Highest Price?

Highest prices are generally paid by homeowners. They buy very small quantities of processed gas delivered directly to their homes through an extensive distribution system. They must pay for the processing and delivery. They must also pay the costs of metering, billing, distribution system maintenance and customer service. They pay the highest price for gas because so many services are required. They pay what is known as the "residential price."

Natural Gas Consumer Sectors and Price Quotes |

|

| City Gate Price ** | The price paid by a natural gas utility when it receives natural gas from a transmission pipeline. "City Gate" is used because the transmission pipeline often connects to the distribution system that supplies a city. |

| Commercial Price ** | The price paid by nonmanufacturing businesses engaged in the sale of goods or services such as hotels, restaurants, stores, and service enterprises. |

| Electric Power Price ** | The price paid by electric utilities and other companies who burn the gas to produce electricity. |

| Henry Hub Price | Henry Hub is a pipeline terminal on the Louisiana Gulf Coast. It is the delivery point for natural gas futures contracts traded on the New York Mercantile Exchange. The "Henry Hub Price" is the amount that will be paid for gas at the Hub on a specified date in the future. |

| Industrial Price ** | The price paid by manufacturing companies who use gas for heat, power, or chemical feedstock. Includes those engaged in mineral extraction, forestry, agriculture, and construction. |

| Futures Price | A "futures price" is a quote for delivering a specified quantity of natural gas at a specified time and place in the future. Buyers who need a long-term supply at a known price will contract for gas with futures. |

| Residential Price ** | The price paid by homeowners who use the gas mainly for space and water heating. |

| Wellhead Price ** | The price paid at the mouth of a well for gas as it flows from the ground without any processing or transportation provided. |

| FOOTNOTES | ** These are natural gas consumer sectors. Prices given for these sectors are averages. They are not fixed prices paid or charged across the sector. |

Other Frequently-Quoted Natural Gas Prices

In addition to "wellhead" and "residential," natural gas prices are quoted in many other ways. These represent the price of gas in a specific business sector (such as the electric power price) or the price of gas in a specific market (such as the Henry Hub futures price). Definitions for some of these price quote methods are provided in the accompanying table.

In What Units are Natural Gas Prices Quoted?

Most natural gas is sold by volume. The volume most often used in the United States is the Mcf (thousand cubic feet - the "M" comes from the Roman numeral for "thousand"). A price quote of $4.55/Mcf would mean that the buyer pays $4.55 for 1000 cubic feet of gas under standard conditions of temperature and pressure.

When very large volumes of gas are being considered, MMcf is sometimes used - MMcf represents one million cubic feet. Bcf and Tcf (billion cubic feet and trillion cubic feet) are also used. Outside of the United States, natural gas is often sold by the cubic meter.

There are some disadvantages for using units of volume when buying or selling natural gas. Units of volume do not allow easy energy comparisons with other forms of fuel. To make fuel type comparisons, natural gas prices can be quoted in MMBtu (one million British thermal units).

The energy content of natural gas varies slightly from one part of the United States to another. However, on average, one thousand cubic feet of natural gas has a heating value of approximately 1.028 million BTU.

Short-Term Natural Gas Price History: A graph showing a short-term history of natural gas prices. The trend in wellhead prices is determined by the complex factors of supply and demand. These are influenced by economic conditions and competing fuels.

Although the residential price appears to be higher during summer months, much of that apparent price increase is explained by consumers using smaller volumes of gas during

summer months and being charged a high rate per unit of gas.

The graphs were prepared by the U.S. Energy Information Administration and are based upon monthly average prices for the United States.

Natural Gas Prices Over Time - Short Term

A graph showing the short-term history of natural gas prices (residential and wellhead) is shown on this page. The price data is based upon monthly average prices for the United States.

The trend in wellhead prices is determined by the complex factors of supply and demand. These are influenced by economic conditions, competing fuels, and even the weather. During late 2007 and early 2008, increasing demand drove prices up rapidly, then in mid-2008 an economic crisis caused prices to decline rapidly.

Although the residential price appears to be higher during summer months, much of that apparent price increase is explained by consumers using smaller volumes of gas during summer months and being charged a high rate per unit of gas.

Long-Term Natural Gas Price History: A graph showing the history of average wellhead prices for natural gas produced in the United States. The price has been extremely volatile in the past decade, with swings from $2 per thousand cubic feet to $11 per thousand cubic feet. The sharp decline in average annual price that occurred in 2009 was in response to a global economic collapse that drastically cut demand. At the same time an abundance of new natural gas fields were being discovered, and that excess supply placed additional downward pressure on prices. The graph was prepared by the U.S. Energy Information Administration and is based upon monthly average prices for the United States.

Natural Gas Prices Over Time - Long Term

A graph showing a long-term history of average annual wellhead prices for natural gas produced in the United States is shown on this page. In the 1950s and 1960s, the number of homes and businesses supplied with natural gas was growing, and a diversity of uses were being promoted. During that time the price of natural gas increased slowly.

The rapid rise in price starting at about year 2000 was caused mainly by the combination of increased demand for natural gas and rising energy prices in general. The sharp decline that occurred in 2009 was a response to the global economic collapse that drastically cut demand. Also in 2008 and 2009, many newly-discovered natural gas fields were being brought online, causing a glut of gas that put additional downward pressure on prices.

What States Have the Highest Natural Gas Prices?

The price of natural gas varies from one location to another. Producers can demand whatever price they want for their gas as long as they can find a willing buyer. Under these conditions supply and demand will determine prices at a local level.

Historically, people who live in areas where lots of natural gas is produced or areas served by major pipelines pay the lowest prices. However, new natural gas discoveries are disrupting this pattern. Those areas are starting to produce gas, but the local gas utility company might still be delivering gas produced outside the area that is supplied under a long-term contract at high prices.

In addition, LNG (liquefied natural gas) is now being shipped from areas where just a few years ago, natural gas was considered a "waste product" of oil production. Construction of new LNG regassification terminals could bring new competition and further change long-term price structures.

The geography of natural gas prices is expected to change significantly over the next decade.

The Future of Natural Gas Prices

Predicting the future is dangerous. The price of natural gas in the future will depend upon factors of supply and demand. Supplies of natural gas are growing. New drilling technology makes it possible to extract quantities of natural gas from tight shale formations that were unproductive in the past. These rock units are present in many parts of the world and are geographically extensive. They have significantly added to the natural gas resource.

Other developments also increase the future supply of natural gas. Compressing natural gas into a liquid (LNG - liquefied natural gas) enables countries without pipeline access to markets to produce gas and ship it to distant locations. Just a decade ago the natural gas in some areas was considered to be a waste product and burned at the well site. LNG makes it a marketable commodity.

Developments related to coal-bed methane, landfill gas, and deepwater drilling all bring new sources of natural gas to potential markets.

On the demand side, there are several ways that natural gas consumption could rise rapidly. Current low prices motivate anyone who can use natural gas as a replacement fuel. Some electric utilities can easily switch to natural gas.

Natural gas use can also be favorable for the environment. Burning gas produces significantly fewer emissions than burning coal, oil, gasoline or diesel fuel. Legislation that limits emissions or incentivizes emission reduction could result in a dramatic increase in natural gas consumption in the electric power industry and other sectors.

Natural gas also has opportunities for tremendous expansion as a vehicle fuel. It is cleaner-burning than gasoline, it can be more cost-effective in many situations, and it is produced locally instead of imported.

In an effort to develop new natural gas resources, many new pipelines are being built. These will deliver natural gas to new markets and increase its use. With supplies increasing and use of natural gas growing, many people believe that 2010-2020 will be the "decade of natural gas."

| More Oil |

|

Horizontal Drilling |

|

Oil and Gas Rights |

|

Shale Gas Resources |

|

Gifts That Rock |

|

What is LNG? |

|

The Doorway to Hell |

|

Natural Gas Investing |

|

Helium |

Find Other Topics on Geology.com:

|

| ||

|

| ||

|

| ||

|

|